child tax credit october date

In Connecticut families can also claim 250 per child which is capped at three children - for a total of 750These payments started rolling out in late August. The Child Tax Credit Update Portal is no longer available.

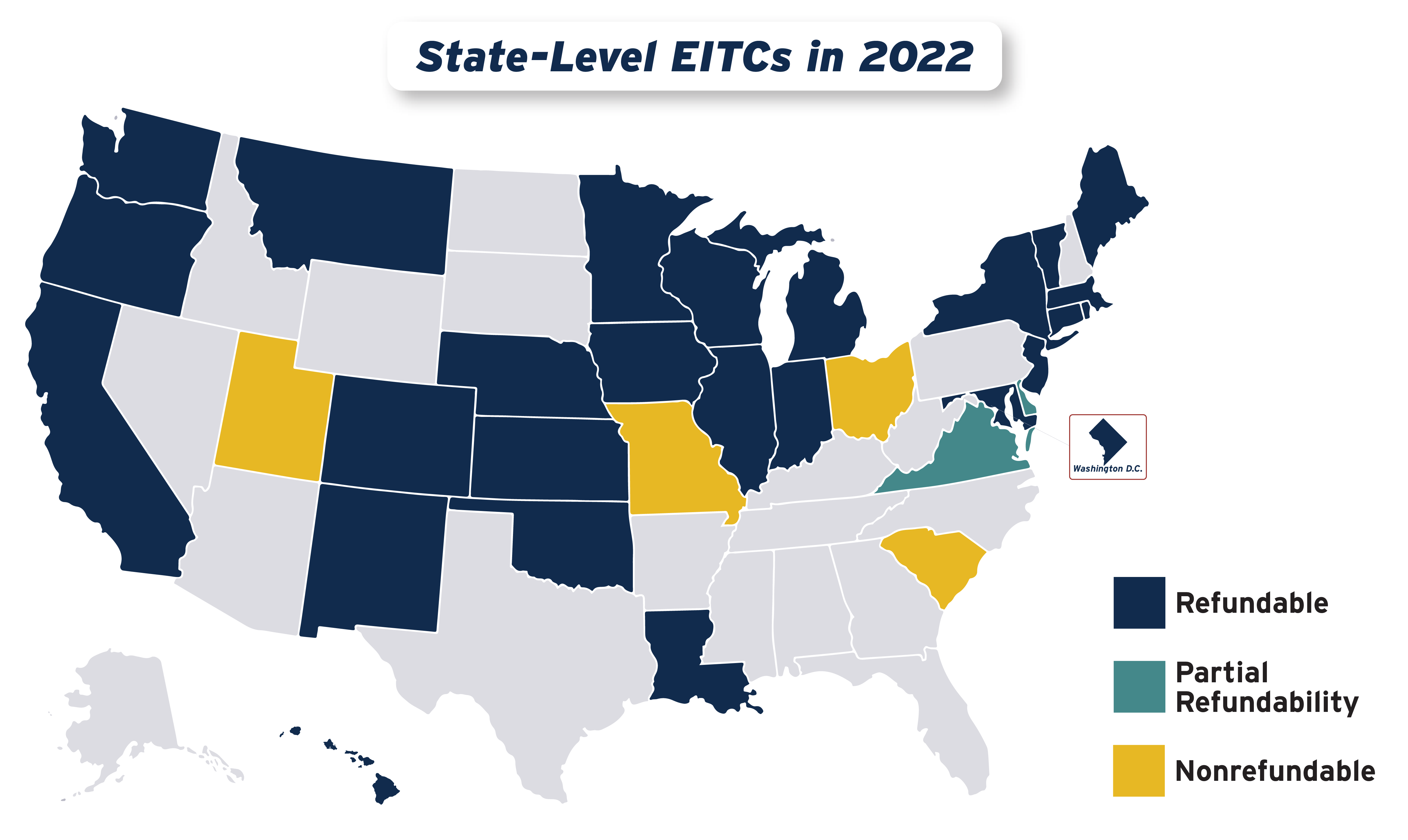

Boosting Incomes And Improving Tax Equity With State Earned Income Tax Credits In 2022 Itep

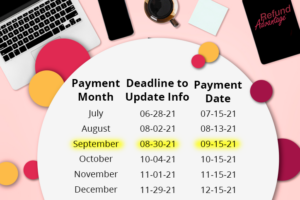

The remaining payments will arrive October 15 November 15 and December 15 each total up to.

. Ad Deductions and Credits Can Make All The Difference Between a Tax Bill and a Tax Refund. October 20 2022. These Are the Must-Know Dates for Child Tax Credits The remaining dates that families can expect the funds are September 15 October 15 November 15 and December 15.

15 opt out by Aug. Child tax credit payments worth up to 300 will be deposited from October 15 Credit. In Rhode Island families will get 250 per child and a maximum of 750 total for up to three children with direct payments going out beginning in October.

We dont make judgments or prescribe specific policies. Supplemental Security Income Benefits. Only one child tax credit payment is left this year.

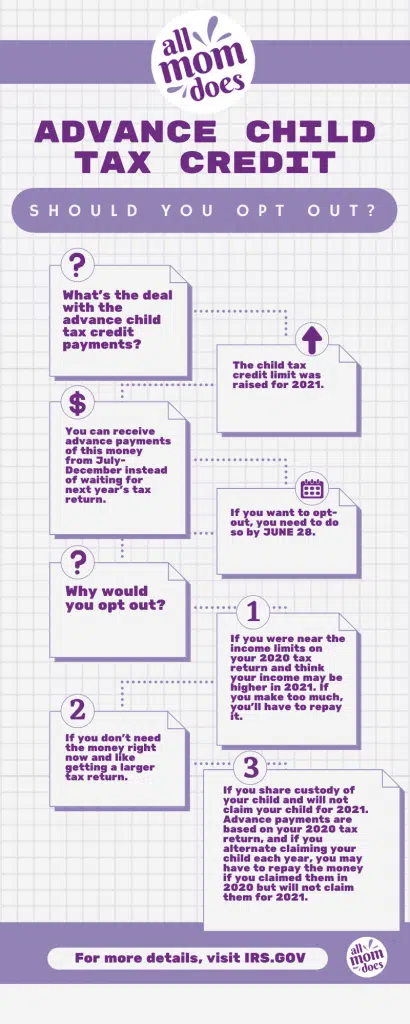

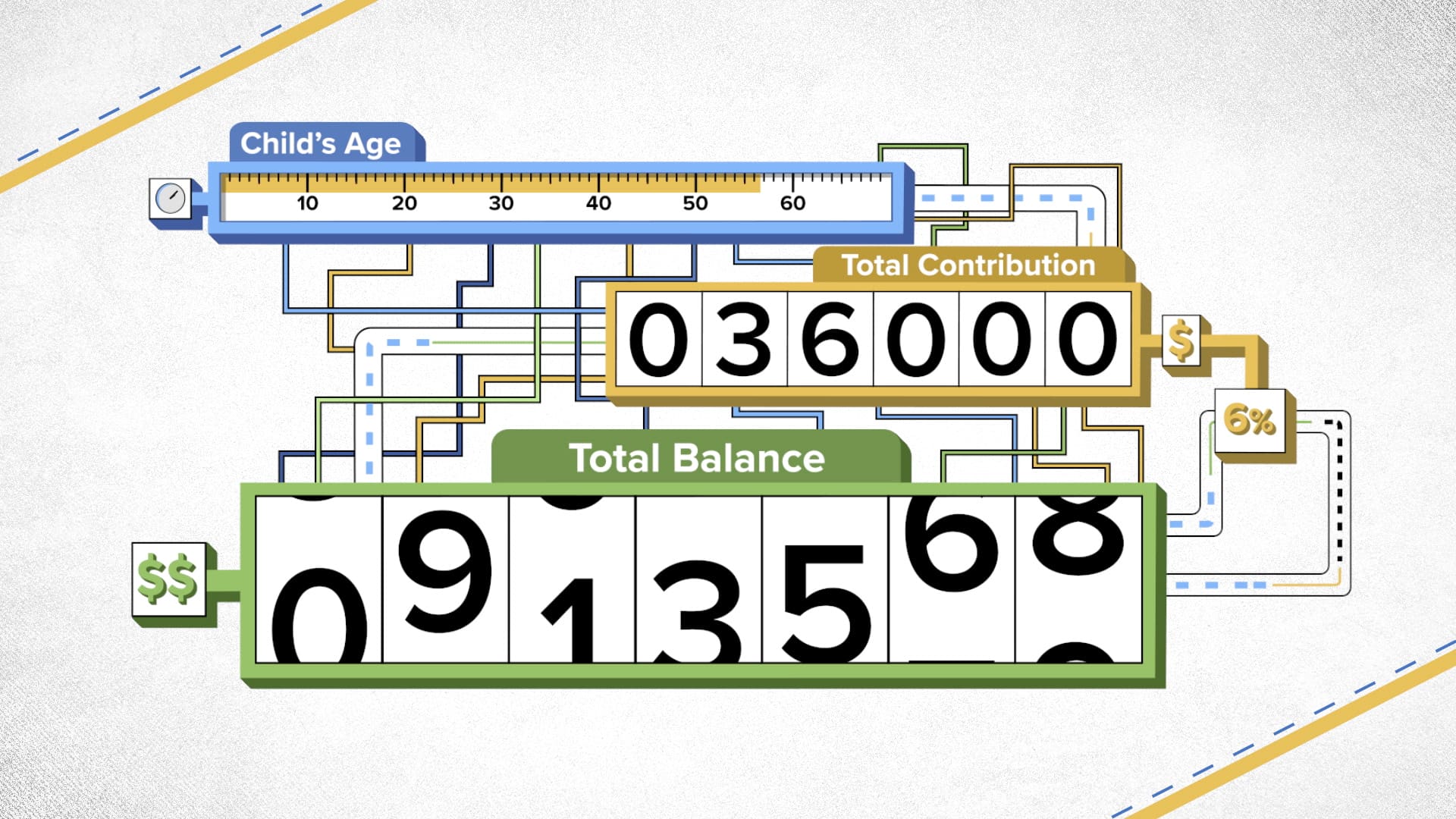

Next payment coming on October 15. See what makes us different. The advance is 50 of your child tax credit with the rest claimed on next years return.

The IRS is relying on bank account information provided by people. Here are the official dates. Well tell you when this payment will arrive and how to unenroll.

13 opt out by Aug. Even though you can still file a 2021 tax return by October 17 or November 15 to get your child tax credit if you didnt receive it the enhanced 2021 child tax credit program. Child Tax Credit Dates.

Your next child tax credit payments could be worth 900 per kid Credit. Everything you need to know. Those that qualify for the advanced payments and didnt unenroll themselves from.

October Child Tax Credit Date. The fourth payment date is Friday October 15 with the IRS sending most of the checks via direct deposit. Goods and services tax.

Under the American Rescue Plan the maximum child tax credit rose to 3000 from 2000 per child for children ages 6 and older and it rose to 3600 from 2000 for. You can no longer view or manage your advance Child Tax Credit Payments sent to you in 2021. The 2021 child tax credit payment dates along with the deadlines to opt out are as follows.

October 29 2021 In October the IRS delivered a fourth monthly round of approximately 36 million Child Tax Credit payments totaling 15 billion. 6 Often Overlooked Tax Breaks You Dont Want to Miss. IR-2021-153 July 15 2021 The Internal Revenue Service and the Treasury Department announced today that millions of American families have started receiving.

You qualify for the full amount of the 2021 Child Tax Credit for each qualifying child if you meet all eligibility factors. The payment is 250 for a child from 6 years old to 17 years old or 300 for a child under 6 years of. W ith Novembers payment now out the IRS is down to one payment left this.

That means another payment is coming in about a week on Oct. October 17 is the deadline for filing 2021 tax returns if you. IR-2022-179 October 14 2022 The Internal Revenue Service reminds taxpayers today that those who requested an extension of time to file their 2021 income tax return that.

Expanded the usual child tax credit from 2000 per child to 3600 per child under age. October 17 is the tax filing deadline for those who requested an extension from the IRS. Learn More at AARP.

Ad Non-partisan not-for-profit resource for US data statistics on a variety of topics. Ad The new advance Child Tax Credit is based on your previously filed tax return. Wait 5 working days from the payment date to contact us.

IR-2021-201 October 15 2021 The Internal Revenue Service and the Treasury Department announced today that millions of American families are now receiving their. The payments will be made either by direct deposit or by paper check depending on what. As part of the.

December 13 2022 Havent received your payment. Octobers child tax credit advanced payment is right around the corner. If you received advance payments of the Child Tax Credit you need to reconcile compare the total you received with the amount youre eligible to claim.

The child tax credit scheme was expanded to 3600 from 2000 earlier this. Have been a US.

:no_upscale()/cdn.vox-cdn.com/uploads/chorus_image/image/70761715/1235261204.0.jpg)

Why Did Congress Let The Expanded Child Tax Credit Expire Vox

Irs Tax Refund Calendar 2022 When To Expect My Tax Refund

Stimulus Update 5 Reasons Your October Child Tax Credit Payment Hasn T Arrived Yet

Additional New York State Child And Earned Income Tax Payments

Irs Child Tax Credit Oct 2022 Don T Miss Extra 1 800 Per Child Finance

Refund Advantage A Division Of Metabank Child Tax Credit Calculator Help Families Understand Actc

How To Apply For The Connecticut Child Tax Rebate Before The Deadline Sunday Connecticut Public

Looking For Cpe This Month Check Out Kbkg S Free Webinars

Child Tax Credit Payment Schedule For 2021 Kiplinger

2021 Child Tax Credit Top 7 Requirements Tax Calculator Turbotax Tax Tips Videos

Should You Opt Out Of The New Advance Child Tax Credit Payments Here S What You Need To Know Allmomdoes

October Tax Deadline Looms For Millions Of Filers Who Got Extensions Here S The Key Date

Late Child Tax Credit Payments From Irs Arriving Now Fingerlakes1 Com

Recovery Package Should Permanently Include Families With Low Incomes In Full Child Tax Credit Center On Budget And Policy Priorities

These Are All The Important Child Tax Credit Dates You Need To Know

Elm3 S Guide To The 2021 Child Tax Credit Tax Accountant Financial Planner

What Families Need To Know About The Ctc In 2022 Clasp

What To Know About The First Advance Child Tax Credit Payment